Ethereum Price Prediction: Analyzing the Path to $10K and Beyond

#ETH

- Technical indicators show ETH testing crucial support levels with mixed momentum signals

- Institutional accumulation totaling over $220 million offsets security concerns and creates strong buying pressure

- Long-term price projections suggest potential for 10x growth by 2040 based on adoption trends and technology development

ETH Price Prediction

Technical Analysis: ETH Shows Mixed Signals Near Key Support

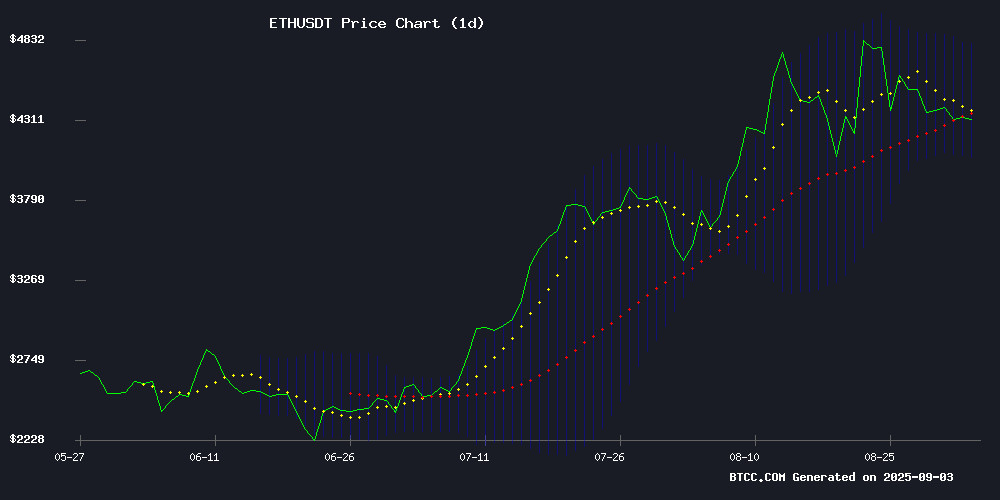

Ethereum is currently trading at $4,324.83, sitting below its 20-day moving average of $4,438.03, indicating potential short-term bearish pressure. The MACD reading of -34.08 suggests weakening momentum, though the positive histogram value of 51.85 indicates some bullish divergence may be forming. According to BTCC financial analyst Emma, 'ETH is testing crucial support NEAR the lower Bollinger Band at $4,067.78. A hold above this level could trigger a rebound toward the middle band at $4,438, while a break below might accelerate selling pressure.'

Market Sentiment: Institutional Accumulation Offsets Security Concerns

Recent news flow presents a mixed but cautiously optimistic outlook for Ethereum. Major institutional acquisitions from Yunfeng Financial ($44M) and SharpLink Gaming ($176M) demonstrate growing corporate treasury adoption, while the ethereum Foundation's strategic sale of 10,000 ETH appears designed to fund development rather than signal bearishness. However, security concerns persist following BunniXYZ's $8.4 million exploit. BTCC financial analyst Emma notes, 'The institutional accumulation trend is overwhelming negative news, suggesting smart money is positioning for longer-term growth despite short-term volatility.'

Factors Influencing ETH's Price

SharpLink Expands Ethereum Holdings to $3.6B Amid Strategic Accumulation

SharpLink Gaming has aggressively expanded its Ethereum portfolio, adding 39,008 ETH worth $177 million in late August. The firm now holds 837,230 ETH valued at $3.6 billion, cementing its position among corporate crypto leaders.

Since June 2nd, the company has deployed a two-pronged strategy: acquiring 314,000 ETH at an average price of $4,500 while earning 2,318 ETH in staking rewards. The final week of August alone yielded 500 ETH in passive income.

Treasury management remains dynamic, with recent purchases funded partly through share issuance. Undeployed cash reserves of $71.6 million suggest potential for further accumulation as SharpLink balances asset appreciation with yield generation.

BunniXYZ Halts Contracts Following $8.4 Million DeFi Exploit

BunniXYZ, a decentralized exchange leveraging Uniswap v4, has suspended all smart contracts after an exploit drained $8.4 million in user funds. The platform had amassed nearly $50 million in Total Value Locked before the attack, signaling early traction in the competitive DeFi landscape.

The breach targeted BunniXYZ's proprietary Liquidity Distribution Function (LDF), a mechanism designed to optimize trading range liquidity. Attackers exploited flawed rebalancing logic by executing precisely sized trades, siphoning assets primarily from Unichain with smaller losses on Ethereum.

Project developers responded within minutes, freezing contracts across all networks and urging users to withdraw remaining funds. Forensic analysis with security auditors is underway to identify the vulnerability's root cause and establish recovery protocols.

Ethereum Price Breakout Signals $10K Target Ahead

Ethereum is capturing market attention with technical patterns reminiscent of its 2021 bull run. Analysts observe a striking similarity between the current setup and the trajectory that previously propelled ETH from $200 to $4,000. The emergence of an inverse head-and-shoulders pattern—with a left shoulder at $2,200, head at $1,500, and right shoulder surpassing $3,500—suggests potential for upward momentum.

Institutional demand is amplifying the bullish case, with spot ETFs absorbing over 286,000 ETH in a week. This supply squeeze coincides with a critical retest near $2,000, mirroring the consolidation phase before previous breakouts. Resistance at $4,943 now stands as the decisive threshold; a clean breach could validate the pattern and fuel the projected rally toward $10,000.

Ethereum Foundation Announces Sale of 10,000 ETH to Fund Development Initiatives

The Ethereum Foundation revealed plans to sell 10,000 ETH, valued at approximately $43 million, through centralized exchanges over the coming weeks. Proceeds will support research, development, and ecosystem grants. The foundation emphasized a gradual selling approach via smaller orders to minimize market impact.

This move follows the introduction of a new treasury policy in June, capping annual operational expenses at 15% and establishing a multi-year reserve buffer. The foundation previously sold a similar amount to SharpLink Gaming in July, marking the first public company purchase from a key Ethereum ecosystem entity.

Ethereum's price surge continues, reaching an all-time high of $4,866 in late August. Current trading levels hover around $4,330, reflecting a 2% daily gain. The foundation's disciplined financial strategy appears timed to capitalize on favorable market conditions while sustaining long-term ecosystem growth.

Bunni DEX Loses $8.4 Million in Sophisticated Smart Contract Attack

Bunni DEX suffered an $8.4 million exploit targeting its proprietary Liquidity Distribution Function (LDF), a custom mechanism designed to optimize liquidity provider returns. The attacker manipulated trade amounts to distort pool rebalancing calculations, syphoning $2.4 million from Ethereum and $6 million from Unichain before bridging funds via Across Protocol.

Security analysts traced the stolen assets to specific wallets containing $1.33 million in USDC and $1.04 million in USDT. The breach underscores persistent vulnerabilities in DeFi's composability, particularly when protocols deviate from battle-tested standards like Uniswap v3.

Uniswap Foundation Leads Push for DAO Legal Clarity in US

The Uniswap Foundation has mobilized a coalition of 18 cryptocurrency organizations to petition Treasury Secretary Scott Bessent for regulatory guidance on decentralized autonomous organizations. The Sept. 2 letter highlights how legal uncertainty is driving blockchain innovation offshore, citing Wyoming's DUNA framework as a potential model for federal adoption.

Wyoming's 2024 DUNA legislation provides DAOs with legal recognition while preserving decentralized governance. The framework enables contractual relationships, treasury management, and tax compliance without exposing token holders to personal liability—a critical concern for US-based projects. "Many DAOs lack clarity on whether basic operations like signing contracts or managing assets could create personal liability," the letter states.

Senator Cynthia Lummis has endorsed the initiative, aligning with the President's Working Group Report on Digital Assets. The political backing signals growing recognition of DAOs' role in financial innovation, though Treasury Department response remains pending.

Yunfeng Financial Allocates $44M to Ethereum as Treasury Asset

Hong Kong-listed Yunfeng Financial has acquired 10,000 ETH ($44 million) for its corporate reserves, signaling a strategic shift toward treating Ethereum as a treasury hedge rather than a speculative asset. The move follows the firm's July commitment to expand into Web3 infrastructure and tokenized finance.

The ETH purchase, executed on the open market, will be classified as a long-term investment on Yunfeng's balance sheet. Company filings emphasize Ethereum's role in reducing reliance on traditional currencies and enabling "organic integration of finance with technology" for next-generation products.

This allocation places Yunfeng among a growing cohort of public companies—including MicroStrategy and Tesla—that now hold crypto assets as part of treasury management strategies. The board approved the transaction on September 2, framing it as foundational for the group's Web3 innovation roadmap.

Jack Ma-Backed Yunfeng Financial Acquires $44M Ethereum Stake for Web3 Push

Yunfeng Financial Group, a Hong Kong investment firm linked to Alibaba founder Jack Ma, has purchased 10,000 ETH ($44 million) as part of its strategic reserve assets. The acquisition signals accelerating institutional adoption of digital assets, with corporate Ethereum holdings surging 384% to 4.4 million tokens between June and September 2025.

The $12.3 billion asset manager disclosed the move through a Hong Kong Exchange filing, joining a wave of traditional finance players diversifying into cryptocurrency treasuries. Strategic ETH Reserve data shows $13.2 billion in corporate ETH accumulation during the three-month period.

Ethereum (ETH) Price Prediction: Whale Activity and Liquidity Surge Signal Potential Breakout

Ethereum is exhibiting signs of a major bullish breakout, with analysts drawing parallels to its 2017 parabolic rally. The cryptocurrency currently trades near $4,423, with traders eyeing the critical $4,800–$5,000 resistance zone. A decisive breach could trigger a move toward $15,000, according to market observers.

Crypto strategist @EtherNasyonaL highlights Ethereum's consolidation pattern, mirroring the 2017 setup that preceded a 3x price surge. Historical data suggests extended consolidation phases often lead to explosive upside moves. The Journal of Risk and Financial Management documented this phenomenon in a 2017 study, noting such periods frequently culminate in tripling of asset values.

Whale activity and liquidity inflows are fueling speculation of a repeat performance. Market sentiment has turned decidedly bullish, with the $12,000–$15,000 range emerging as a mid-2026 price target among analysts tracking the current technical formation.

Kevin Spacey Collaborates With Alleged Crypto Fraudster on Sci-Fi Film

Kevin Spacey has reemerged in the film industry with "Holiguards Saga—The Portal of Force," a sci-fi project co-created with Vladimir 'Lado' Okhotnikov, a Russian entrepreneur implicated in a $300 million DeFi Ponzi scheme. The film, inspired by Okhotnikov's libertarian ideology, marks the first installment of a planned trilogy.

Okhotnikov, co-founder of Ethereum-based Forsage, faces charges from both the SEC and DOJ for allegedly orchestrating one of the largest crypto frauds in U.S. history. Federal prosecutors describe Forsage's operation as a sophisticated global Ponzi scheme masquerading as a decentralized finance platform.

The collaboration raises questions about the intersection of entertainment and crypto's regulatory gray areas. Spacey's involvement signals a high-profile endorsement of blockchain-adjacent projects, despite ongoing legal scrutiny surrounding his partner.

SharpLink Gaming Expands Ethereum Treasury with $176 Million Purchase

SharpLink Gaming, a Nasdaq-listed company, has significantly bolstered its Ethereum holdings with a $176 million purchase last week. The firm acquired 39,008 ETH at an average price of $4,531, bringing its total stash to 837,230 ETH—now valued at approximately $3.6 billion. This aggressive accumulation aligns with SharpLink's strategic pivot in May to prioritize Ethereum as a core treasury asset.

Ethereum's price surge to a new all-time high in August has coincided with growing institutional interest. SharpLink's co-CEO Joseph Chalom emphasized a proactive approach to capital allocation, stating the company will "remain opportunistic" to maximize shareholder value. The gaming firm raised $46.6 million through its ATM facility to fund the acquisition.

SharpLink's stock (SBET) has surged over 400% since mid-May, though it dipped 5% to $16.89 following the announcement. The move reflects a broader trend of public companies diversifying into crypto assets, with Ethereum emerging as a preferred choice for corporate treasuries.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and fundamental developments, Ethereum appears positioned for significant long-term growth despite near-term volatility. The combination of institutional adoption, ongoing development funding, and growing Web3 integration creates a strong foundation for price appreciation.

| Year | Conservative Forecast | Moderate Forecast | Bullish Forecast | Key Drivers |

|---|---|---|---|---|

| 2025 | $5,800 - $6,500 | $7,200 - $8,000 | $9,000 - $10,000 | ETF approvals, institutional adoption |

| 2030 | $12,000 - $15,000 | $18,000 - $22,000 | $25,000 - $30,000 | Mass DeFi adoption, scaling solutions |

| 2035 | $25,000 - $35,000 | $40,000 - $55,000 | $60,000 - $75,000 | Web3 infrastructure dominance |

| 2040 | $45,000 - $65,000 | $75,000 - $95,000 | $100,000 - $120,000 | Global settlement layer status |

BTCC financial analyst Emma emphasizes that 'these projections assume successful Ethereum upgrades and broader crypto market maturation. Short-term fluctuations are expected, but the long-term trajectory remains fundamentally strong.'